Last modified on January 14th, 2022

By Matthew Kaddatz

How does your property management company stay compliant and efficient when it comes to accounting and reporting? As a previous owner and operator of a property management company, I can attest to the fact that accounting is one of the most complex and time-consuming workflows. It’s also the most critical, as it impacts almost every aspect of your business — from owner retention to leasing to maintenance. When my business processes were not efficient and consistent, errors occurred more frequently, which resulted in many late nights. As the owner of a property management business, you cannot afford to get accounting wrong! Between the risk of failing an audit to the risk of losing customers because of financial inaccuracies, there isn’t space to make mistakes and there is a real need to be efficient.

In part one of our accounting and reporting educational series, I’m going to detail some of the most pressing accounting challenges I faced while operating a property management business — many of which I’m sure you have also encountered — and share with you how you can overcome them by pivoting your strategy and incorporating automated, digital tools.

While this article contains helpful information, I am not providing legal advice and you should consult a qualified tax attorney for any specific questions about your accounting processes or taxes.

Challenge #1: Collecting Rent

A lot of property managers I talk to struggle to collect rent from all of their renters in full and on-time. This is a common issue, but over time it can quickly impact property NOI, owner cash flow, and ultimately stunt your business growth. Some of the reasons why collecting rent is difficult is because many businesses are still only accepting paper checks or money orders, which need to be collected by hand, and then deposited at the bank and manually inputted into the system, which takes extra time and requires double data entry.

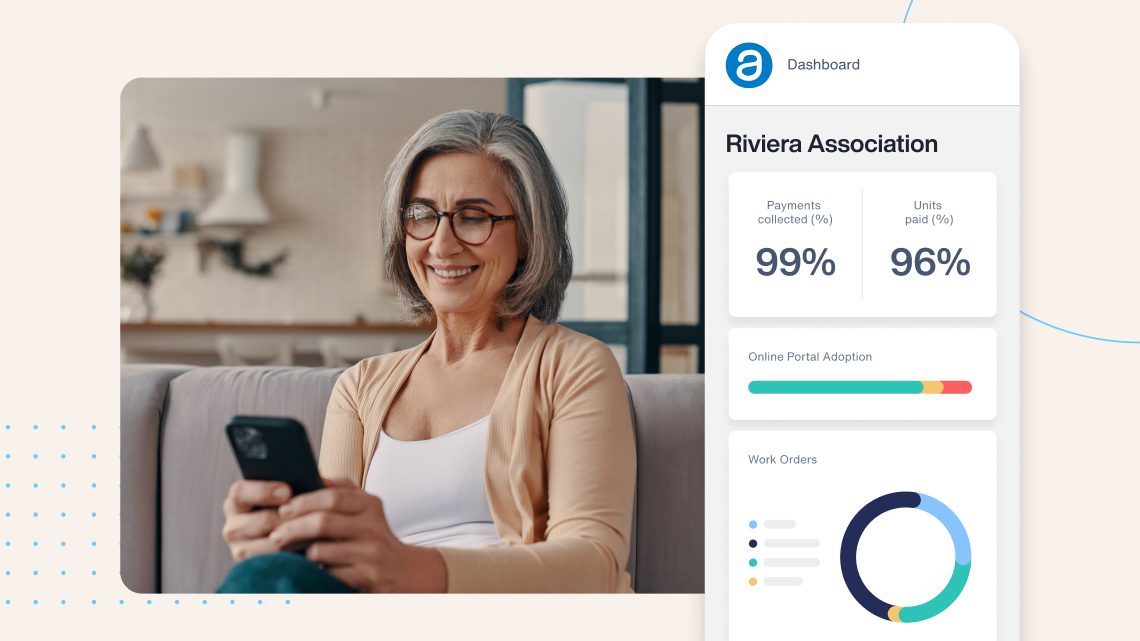

Solution: Offer Online Rent Collection

Rather than collecting paper checks and processing rent by hand, consider transitioning to online payments. Online payments not only save your team time and increase the likelihood that rent will be paid on-time and in full, but are also more convenient and preferred by renters. Millennials and Gen Zers make up the majority of renters today, and are accustomed to using technology to carry out many of their daily tasks, and that includes paying their rent and bills. In fact, according to the 2020 NMHC/Kingsley Apartment Resident Preferences Report, 61% of residents say it is important to be able to pay rent/dues with a mobile device.

Online payments are also better for your owners, because they get money into their accounts faster. For instance, JC Register of Register Real Estate uses direct ACH deposits to expedite payments to his owners. As a result, they are able to transfer their money within 12-24 hours: “I tell owners that if they come on board, they don’t have to wait for a check. The money is in their account within 12-24 hours. They really like that,” says JC.

Challenge #2: Reconciling Books

Back when I was running my business, we used generic systems like QuickBooks and Excel spreadsheets to reconcile accounts. This required us to do a lot of double data entry, which often led to errors and inconsistencies that required a lot of time to get resolved. These systems don’t force every transaction to be tied to a property, so it took a lot of effort to ensure we had accurate property based P&Ls. Additionally, they are not set up for trust accounting, so there was a need for manual Excel double entry. All of this made reporting a very large challenge and very manual.

Solution: Move to a Single Solution

When all of your business data is in one system it’s easier to have a clear understanding of your finances and ensure accuracy. When you have a solution that offers reconciliation and diagnostic reports, you can quickly run reporting to ensure your numbers align.

Lisa Kennedy of Northwest Commercial has had great success since she transitioned to an integrated solution that has built-in reconciliation: “Now payments go in automatically, then accounting pulls the reports and audits, and makes sure everything is reconciled. It has really streamlined our entire process from start to finish.”

Challenge #3: 1099s & Year-End Close

One of the tasks I used to dread all year was preparing and sending 1099s. It was always a very tedious, complex, and time-consuming process. However, if I didn’t submit them on-time, then I could have faced heavy penalties from the IRS — as much as $30-$100 per late 1099 form — and opened my business up to an audit. Closing our books was another cumbersome workflow, yet it was absolutely necessary. If I didn’t, then I wouldn’t be able to calculate how much money I received from owners and paid to vendors, which would have made it almost impossible to understand how my business was performing.

Solution: Leverage Automation

Automation makes submitting 1099s and closing books a lot easier, and also removes the risk caused by manual data entry errors. There is tremendous value in generating 1099s automatically and to have accompanying reports, as it saves time, and ensures dollar amounts are accurate, clear, and transparent to owners.

An advanced system like AppFolio Property Manager makes it easier and faster to process your 1099s because it already has all of your vendors’ and owners’ information in the system. AppFolio also provides support for the newly added 1099-NEC form, which is now required to report on vendor earnings.

Challenge #4: Owner Packets

Lastly, preparing owner packets was always a challenge for me and my team. It took up a lot of time, and when I didn’t have accurate data that was easy to access, I worked well into the night to avoid customer confusion and owner dissatisfaction.

Solution: Adopt Reporting Tools

Reporting tools can analyze the data on your behalf and automatically generate owner reports, saving time and enabling you to get a clearer picture of your finances in minutes. Consider switching to a platform that has these tools, along with built-in analytics that can spot errors or inconsistencies in your data. A digital system also makes it easier and faster for you to share reports and owner packets instantly, all online — no more paper, envelopes, and stamps.

As you and I both know, accounting definitely comes with its own set of challenges, however if you standardize your processes and put automated, digital tools to work, you can save time, increase accuracy, and stay compliant. Make the most of the solutions I shared above and you’ll be able to set your business up for success — not only for this tax season, but the entire year.

About the Author

Matthew Kaddatz is the Sr. Director of Product at AppFolio Property Manager. Matthew has spent the past 15 years working in the property management industry with experiences including founding and operating a property management company, as well as building technology for property management companies. In his current role, he is responsible for ensuring AppFolio is continually building innovative tools that help property management businesses grow and become more efficient.

Comments by Matthew Kaddatz